Kop have been able to substantially offer reduced costs and integrated solutions to the likes of Apex Group, JTC and iQeQ, providing solutions to assist with KYC/CDD and Fund Management.

Founded in 2006, Puritas has grown, becoming a leading provider of fund administration, fund management and client data management solutions, supplying award-winning, high quality and functionally complex software applications to the financial services industry.

For more information or a demo of the solutions they offer please contact Kop today.

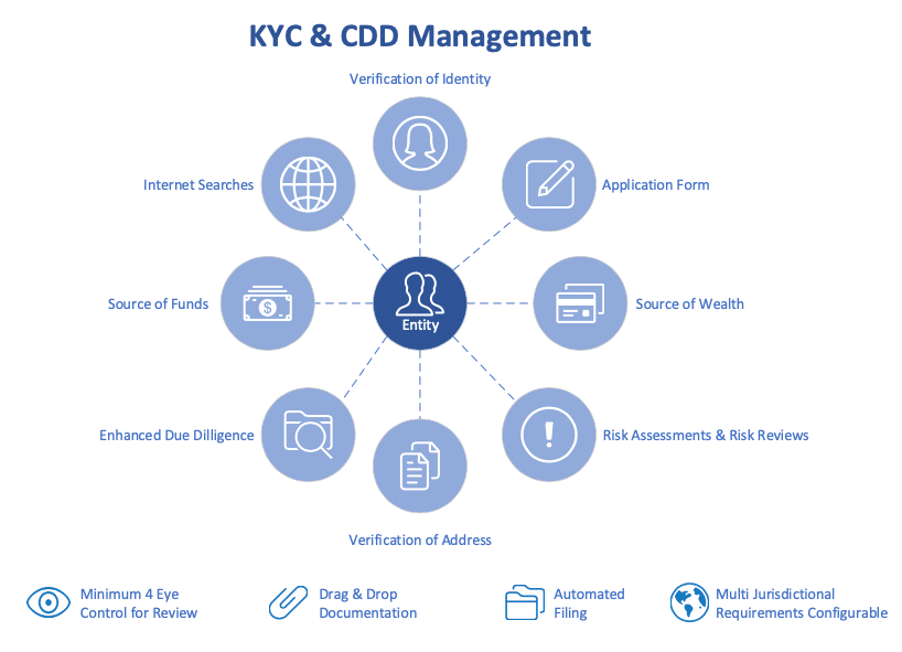

KYC, CDD & AML

We provide a multi-jurisdictional CDD and AML solution for companies needing to manage all CDD data, documents and reporting statuses for each entity.

Our solution automatically recommends different types of CDD depending on the entity type, risk or relationship for individuals or any corporate entity type.

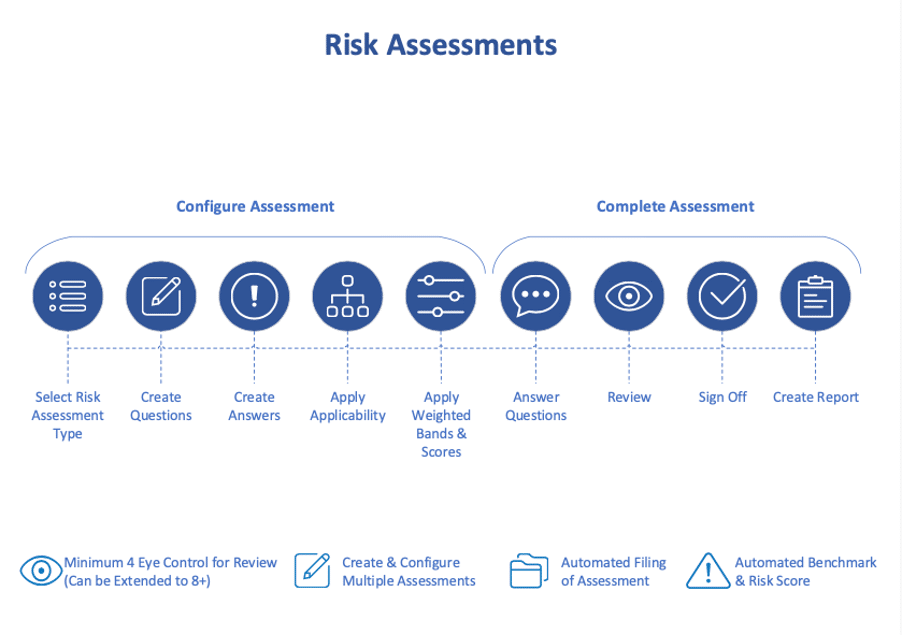

Risk Management

Our platform provides the functionality needed to create multiple risk assessments for all entities based on fully configurable templates containing required questions, answers and weighting bands to automatically produce the risk score.

Business rules options allow overriding of calculated assessment scores with all steps subject to four+ eyes approval.

On-boarding for individual & corporate

We have a dynamic onboarding solution that offers a breakthrough approach allowing your business to easily onboard individuals, corporates, funds and trust without the need to rekey in data.

It crucially offers an enhanced client experience through reducing the need to request repeated information.

Entity Data Management – 360 degree view of client

Our advanced platform provides the opportunity to finally move to a single source of truth for all client and entity-relationship data and the ability to hold any type of entity or create any type of relationship structure.

The solution either stands alone or can interface with other client systems and platforms through API connectivity.

FACTA & CRS

Our automated FATCA and CRS solution captures all original data within the platform for easy and efficient data completeness analysis with exceptions highlighted for easy remediation processing.

Once data cleansing is complete, both the FATCA and CRS processes are automated using our integrated batch process wizard.

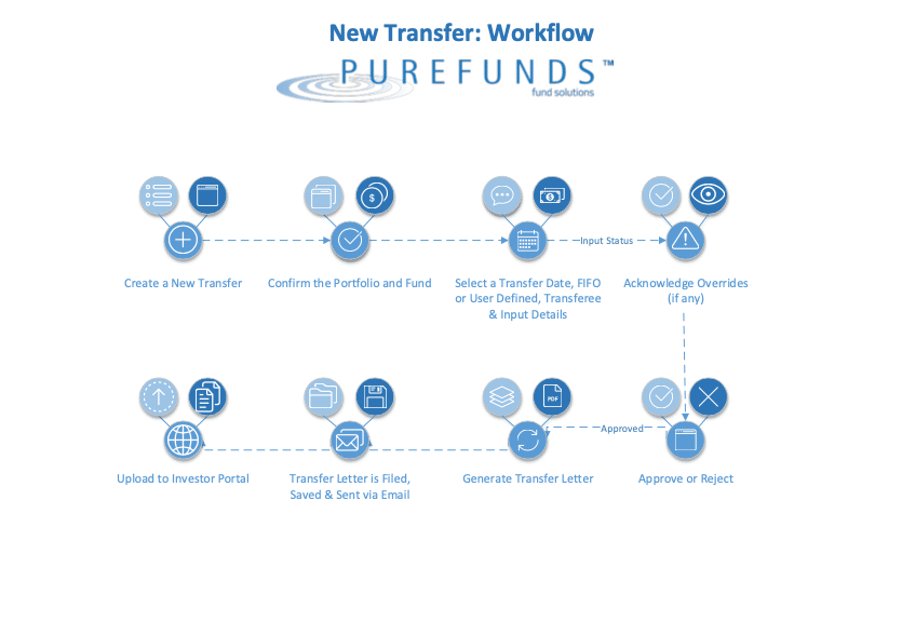

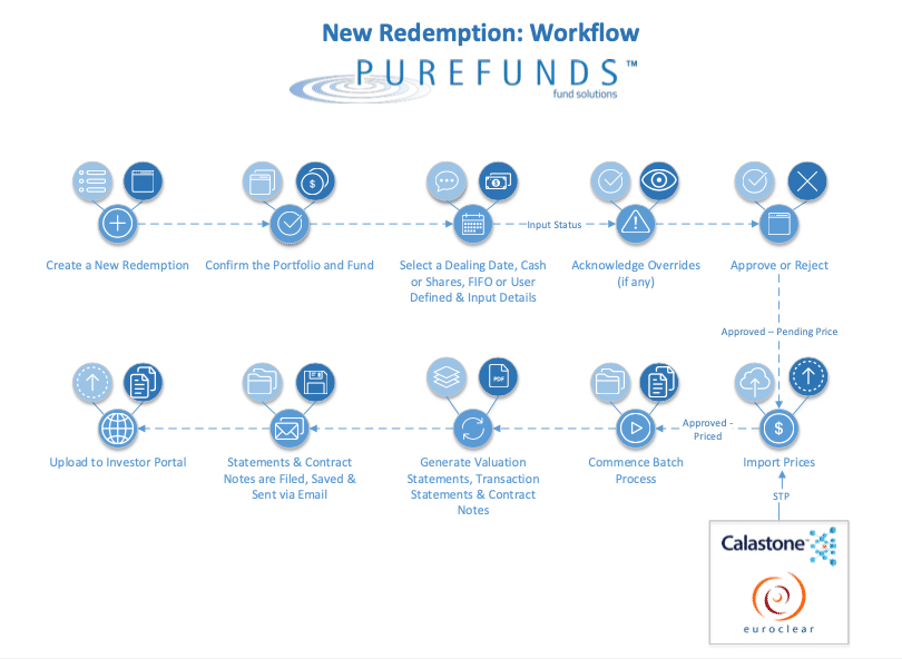

Share Register & Dealing

Our intuitive, responsive and fully integrated portfolio and investment management platform allows the easy scaling of business with confidence through efficient processing of subscriptions, redemptions, distributions and transfers, and updating of investor register.

Possessing a high level of automation via the client Investor Portal along with integration with third party products including Calastone, EMX and World Check.

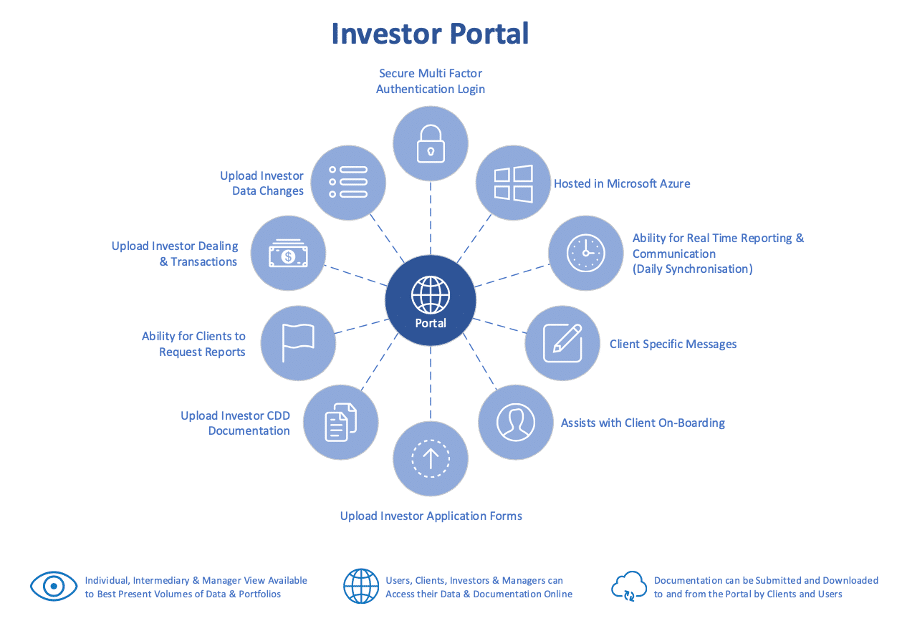

Investor Portal

Hosted in Microsoft Azure or locally, our investor portal provides a secure environment requiring multi-factor authentication to access investor data and correspondence.

The portal provides clients, intermediaries and fund managers with specific access to data and documents allowing them to self serve their needs.

Document Management

Our document management System (DMS) is integrated across all associated Puritas modules.

All documents are securely saved in a separate file share location outside of the database which features a locked-down environment and easy integration into an existing DMS.

Puritas Solutions

Delivering best of breed systems

Puritas products provide a range of thoughtfully designed off-the-shelf software solutions. Each application is designed to provide the range of features that will enable businesses to improve the customer experience as well as delivering high performance with a cost-efficient approach.

PureClient

Delivers a fully integrated record-keeping and data management platform incorporating all CDD, AML and Risk into one standardised system.

PureClient is a client administration system that easily manages private and institutional investor details and reporting providing an advanced ‘single source of truth’ software solution that clearly does this… and so much more.

- Has been developed with customer and compliance in mind.

- Is a fully integrated platform incorporating all CDD and risk controls and assessments into one standardised system.

- Allows you to easily manage workflows and process necessary actions in a co-ordinated and timely fashion. Because it has been developed in conjunction with compliance industry specialists for today’s stringent business environment, it can easily be updated to comply with changes to legislation and additional regulatory and reporting requirements, providing a ‘single source of truth’ for all client data.

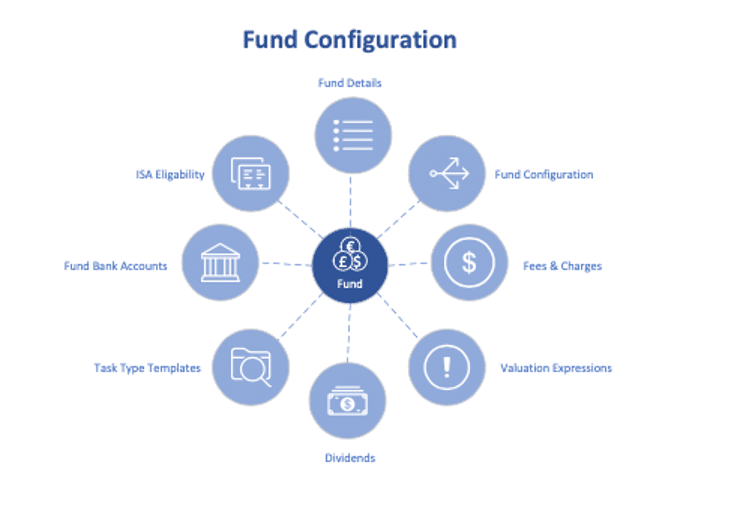

PureFunds

Providing an integrated transfer agency solution with automated dealing and share register features for global fund managers and administrators.

Their intuitive, responsive and fully integrated portfolio and investment management platform allows the easy scaling of business with confidence through efficient processing of subscriptions, redemptions, distributions and transfers, and updating of investor register.

Their solution possesses a high level of automation via the client Investor Portal along with integration with third party products including Calastone, EMX and World Check.

- Has been developed with superior performance and enhanced functionality in mind.

- Provides for the automation of routine administration activities wherever possible. This is achieved through building in decision parameters for each task and creating routines based on consistent intuitive assumptions.

- Results in proven end-to-end efficiencies, leading to increased productivity, and without the need to increase headcount.

PureManager

Clearly enable effective control over operations. Choose a bespoke software solution that reduces complexity of daily administrative tasks for global fund and investment managers.

Their solution reduces the complexity of daily administrative activities for fund and investment managers. Through the automation of standard tasks, it allows the effective control, analysis, reconciliation and reporting of daily trading activity.

- Has been developed to enhance the management and administrative function while decreasing operational requirements.

- Enables the importing and collation of different files and datasets into one database while checking and validating all data before updating bank records and asset registers.

- Allows the manager to track current and future activities based on cash and investment transactions. It permits the manual setup, alteration and configuration of journals and templates. Its integrated reporting tool ensures reports can be created, configured and exported in a range of formats.

PurePortfolio

Choose a flexible and scalable multi-asset software solution for effective configurations of multiple investment portfolios.

Their solutions allow users access to sophisticated tools and applications specifically developed to enhance investment management activities. Through streamlining, automation and integration they reduce complexity, save time, increase security and enhance service.

- Designed to jointly and significantly enhance fund and investment management and administration.

- Provides a multi-asset allocation solution for investment portfolios with the option of spreading the underlying investments over a range of different asset classes, including equities, bonds, absolute return and alternatives.

- Makes PurePortfolio an ideal option for providers of international savings plans or fund of funds investments. They allow the configuration of multi-asset investment plans with a range of funds to suit different investor strategies.

- Each can be tailored to meet the needs of individual investors, offering a flexible and scalable solution. Secure connection to third party fund platforms such as Calastone and EMX along with integrated governance and embedded controls significantly reduces manual intervention to the dealing process.